In the second half of 2024, Ireland is hoping to introduce Auto-Enrolment Pensions. Many people will have heard whispers, and some may be fully aware of it. However, for many employers, there is a bit of concern as to exactly what they may or may not need to do about it all!

We will be hosting an in-depth webinar at 1 pm on 26th January 2024 with Stephen Gillick, Partner and Head of Pensions at Mason Hayes & Curran LLP. This webinar will detail the most important information you will need to know about auto enrolment, particularly from a business owner’s perspective.

To register for this free webinar CLICK HERE to book your spot.

Now let’s take a quick look.

Background of Auto Enrolment Pensions

Ireland’s pension auto-enrolment program was officially launched in 2022, after much delay and fanfare! It marks a significant stride towards securing the financial futures of the Irish workforce. The initiative addresses the growing concern of not enough individuals having enough savings to supplement the State Pension and ultimately to maintain a comfortable lifestyle during retirement for themselves. With life expectancy on the rise, planning for retirement has become more crucial than ever!

How it Works

The concept behind auto-enrolment is simple yet powerful. Instead of relying on individuals to actively sign up for a pension plan, the government has taken the proactive step of automatically enrolling eligible employees into a workplace pension scheme if they don’t already have one. Employees still retain the flexibility to opt out if they choose, but the default option is to participate—a smart nudge toward long-term financial planning.

And it is all based around ‘Nudge Theory‘ which is a powerful behavioural economics theory. It is based on the fact that we are much more likely to do stuff that is good for us (and bad for us) if we get a gentle nudge towards that action. A crude but interesting example of this was in the early 1990s; Amsterdam’s Schiphol Airport printed pictures of flies on its men’s room urinals in an effort to reduce “spillage”. It had a dramatically positive impact; improving users “aim”, and reducing cleaning costs dramatically!

So the Irish Government are nudging us all to improve our financial aim, and direct some of our financial resources to the future, and to reduce financial spillage!

Eligibility

The Auto-Enrolment Pensions initiative targets employees aged 23 to 60 who earn over €20k per year. “This ensures that those who need it most are included in the program, while also allowing flexibility for those who may have alternative retirement plans.”

You can opt out or suspend your contributions after six months if you want or need to. However, you’ll be re-enrolled after two years, nudged back in so to speak! Once re-enrolled you can again opt out after another six months if you want or need to – but you can see that the Dept of Social Protection really want you to stay enrolled!

If you are already a member of an Occupational Pension scheme you are most likely better off staying put. Particularly if you earn over €42k per year or are paying tax on any income at 40% – because you are getting 40% tax relief on any and all contributions you are making to that scheme, whereas you’ll only get 33% in the Auto-Enrolment scheme (plus you are probably getting more generous employer contributions in the existing Occupational Scheme!). Auto-Enrolment is really aimed at those in the €20k to €40k salary range that have no active pension in place.

Auto-Enrolment Pensions – Contributions

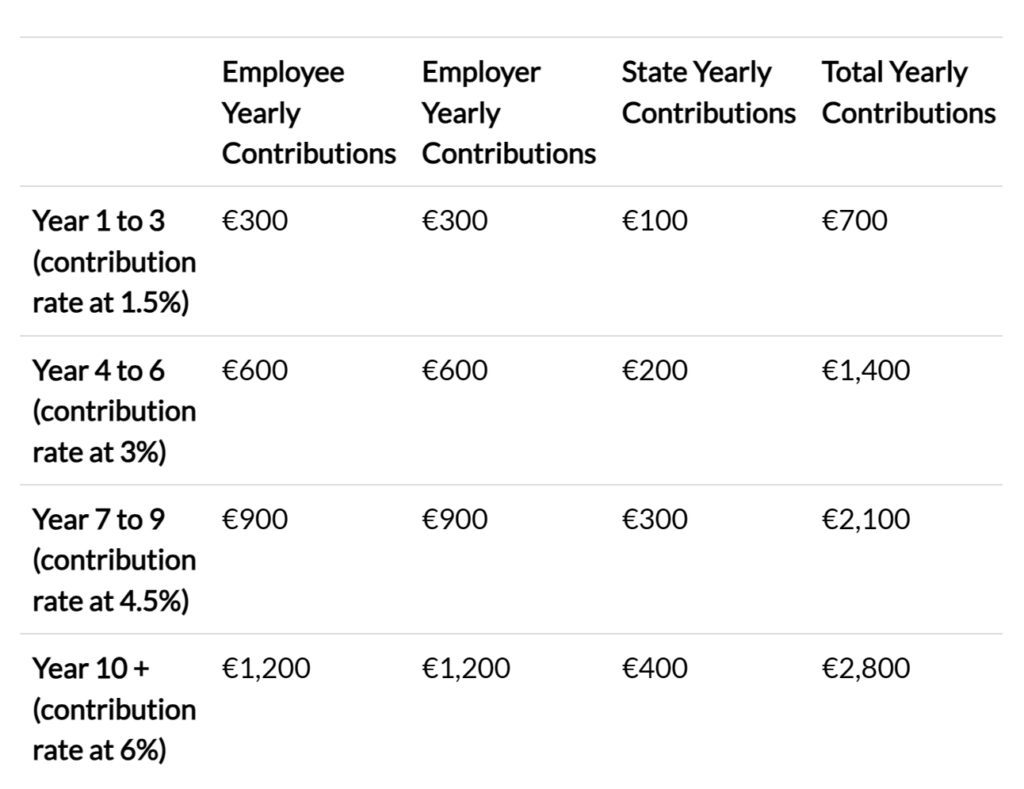

Employers, employees themselves and the Government will play a role in funding the pension scheme. According to the government, every €3 an employee contributes, the employer will match that, plus a €1 contribution from the government. This makes a contribution of €7 for every €3 the employee contributes. The minimum employer and employee contribution depends on the length of time in the scheme, increasing from minimum 1.5% of salary to 6% by year 10. Gov.ie has the following nice worked example, for someone earning €20,000 per year.

Auto-Enrolment Pensions – Benefits for Employers

Employers stand to gain from the Auto-Enrolment Pensions program as well. Not only does it contribute to the overall financial wellness of the workforce, but it can also enhance employee satisfaction and retention. A content and financially secure workforce is likely to be more engaged and productive, creating a win-win situation for both employers and employees. All contributions are deductible for Corporation Tax purposes, but you will need to ensure payroll can deduct and handle the contributions.

Communication and Education

The Irish government claims to be investing heavily in the promotion and education around auto-enrolment, including providing accessible resources and tools for individuals to calculate their potential retirement income and make informed choices.

Whether people are using these resources of course is the question – my sense is that auto-enrolment is far down the list of priorities for employers – they’ll worry about it when it comes into force. I suggest joining our webinar on 26th Jan next year to ensure you aren’t caught out and under pressure when it comes into force.

Conclusion Auto-Enrolment Pensions

Ireland’s pension auto-enrolment initiative is a step towards building a more financially resilient society. No question. We have seen countries such as Australia and the UK where it had positive and meaningful impact.

By encouraging a savings mindset and making retirement planning more accessible (mandatory!), the program will hopefully alleviate some financial burdens that some individuals face in their later years. No scheme is perfect but as the initiative evolves and embeds itself over the years, it has the potential to create a brighter and more secure future for the people of Ireland. And that is surely a positive thing.

I hope this helps.

Paddy Delaney QFA RPA APA

The post Auto-Enrolment Pensions In Ireland: A Brief Intro….blog237 appeared first on Informed Decisions.

Leave a Reply