Author: petersgreatwebsites.com

-

NEW Don’t Jump Ship on Bonds: A Prudent Investment Choice. Blog 229 !!!

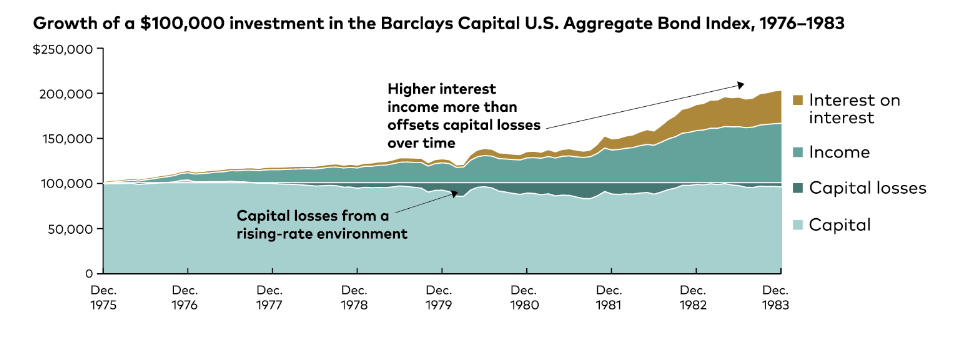

In the ever-evolving ocean of investments, where trends and fads can shift like the currents of the oceans beneath us, it’s essential to keep a steady hand on the wheel. Amid the chorus of voices clamoring for the latest high-flying assets, one must pause and reconsider the tried-and-true: bonds. As financial advisors, it’s our duty…

-

JUST OUT 5 Trends In Progressive Financial Advice -Blog230 !!

I was fortunate to attend FutureProof last week, the world’s biggest Wealth Management and Financial Advice conference, attended by c3,000 Financial Advisors. It was held in L.A, California and so was attended mostly by US and Canadian advisors and institutions. And given US/Canada are probably 15 years ahead of us in progressive advice in clients’…

-

NEW Money Market Funds For Company Cash? Blog231 !!

Today, we embark on an oceanic exploration of a topic of paramount significance to every discerning business owner, whether or not to use Money Market Funds for Company cash! Indeed, this topic can and will apply to business owners and non-business owners alike, it’s just that business owners are usually more concerned about having large…

-

LATEST Money Market Funds in Ireland – Real or Unreal!? Blog232 !!!

Only last week I wrote about Money Market Funds in Ireland and how they should and should not be used by businesses to generate some returns on their liquid cash. But I want to explore whether Money Market Funds in Ireland are a real and valuable investment vehicle that everyone should consider, or if they…

-

JUST OUT Taxation of ARF & Your Tax Contributions in Ireland blog233 !!

How does taxation of ARF and your Tax work in Ireland work? The taxation of Approved Retirement Funds (ARF) and understanding your Pay-Related Social Insurance (PRSI) contributions are essential aspects of financial planning, especially for retirees. Before we jump in to ARF and Tax, let’s put to bed the question of how much tax you…

-

LATEST Severance Payments and Taxes in Ireland: Are They Taxed? Blog234 !!!

When it comes to leaving a PAYE job or winding up your own company, there are various types of severance payments you might receive, or give yourself! But what about the tax implications of these payments? In Ireland, the tax treatment of payments on cessation of employment can seem like pie in the sky for…

-

NEW 20 Investment Tips For Irish Investors To Navigate. Blog235 !!!

I recently came across a wonderful infographic showing 20 mistakes that investors make, and which they should try to avoid. It reminded me that sometimes we in the investing world talk down to retail investors, many of whom are way smarter than those actually in the investment world! It also reminded me of a parenting…

-

LATEST A Guide to Gifting €2m To Your Family, Tax Free! Blog236 !!!

Gifting tax free to family, even large sums such as €2m. At first glance, this seems impossible and/or undesirable but with smart planning it is possible to avoid all tax burdens on such a gift, legally and legitimately. In Ireland, the tax landscape, especially concerning wealth transfer, can be a bit like navigating a maze.…

-

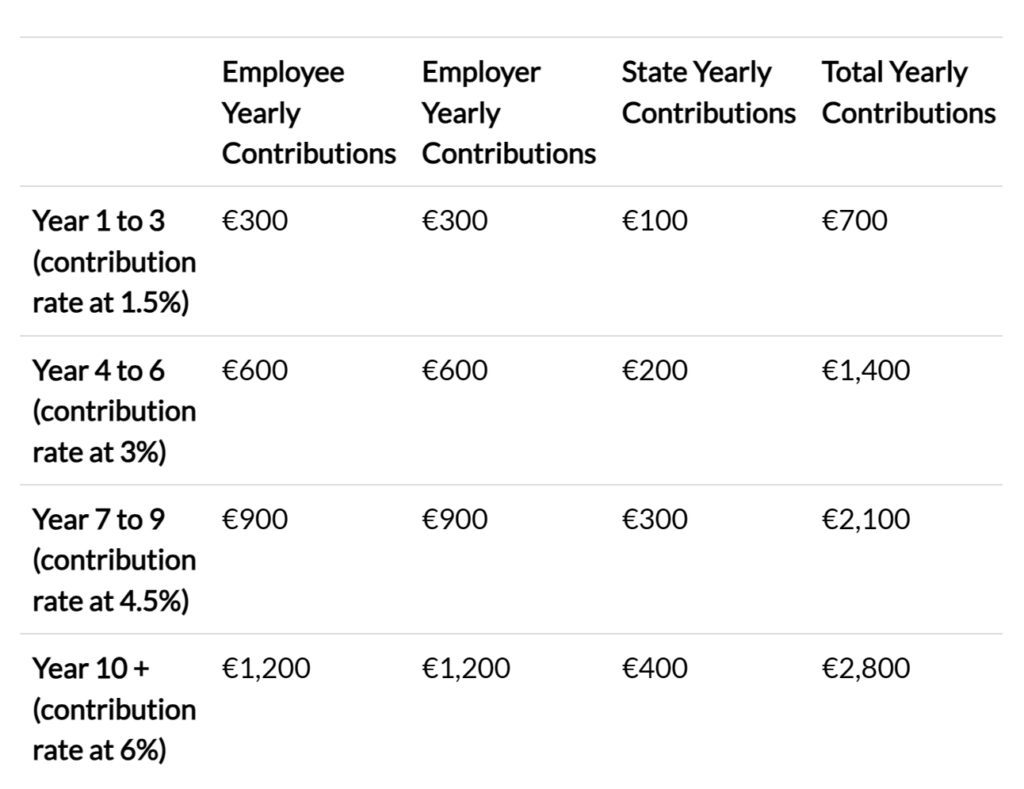

JUST OUT Auto-Enrolment Pensions In Ireland: A Brief Intro….blog237 !!!

In the second half of 2024, Ireland is hoping to introduce Auto-Enrolment Pensions. Many people will have heard whispers, and some may be fully aware of it. However, for many employers, there is a bit of concern as to exactly what they may or may not need to do about it all! We will be…

-

NEW Retirement Planning Strategies for Business Owners in Ireland. Blog238 !!!

Retirement Planning Strategies for Business Owners in Ireland Retirement marks a significant milestone in life. And I believe it fair to say that it is especially so for many business owners, who have often spent years nurturing their beloved businesses! In Ireland, effective retirement planning is crucial, not just for ensuring a comfortable retirement but…